At long last, Apple unveiled AirTags at its Spring Loaded event. AirTags are small attachable Bluetooth devices that help keep track of items. We believe AirTags have the potential to be a sleeper hit with consumers and surprise investors over the long run by adding 1% plus to Apple’s overall revenue. While it sounds like a small number, 1% would equate to $3.3B on Apple’s expected 2021 revenue of $333B. As a point of perspective, Sonos, the audio company, does about $1.5B in annual revenue today.

A lesson from AirPods

When AirPods came out in 2016, many investors viewed the potential as limited given the market for bluetooth headphones was declining. Of course, AirPods have been a runaway success, and we now estimate the segment accounts for about 5% of overall revenue. Similar to AirPods, we expect that AirTags will become must-have wearables over the next several years.

In our estimation, investors missed the potential of AirPods because they underestimated the importance of the Apple ecosystem in providing a seamless pairing and compatibility experience between flagship devices (iPhone, iPad, Mac) and wearables (Watch, AirPods). We expect the same will be true with AirTags due to Apple’s ecosystem of a billion-plus devices, along with Apple’s brand and marketing advantage.

The path to a multibillion-dollar business

Apart from the adoption lesson, there’s also a financial lesson from AirPods. That is, when product-market fit happens, growth can be explosive. We estimate that Apple sold about 80m AirPod units in CY20, the fourth full year of AirPod availability. At an ASP of around $170, this equates to $14B in revenue. We estimate the company will sell about 95m units in CY21.

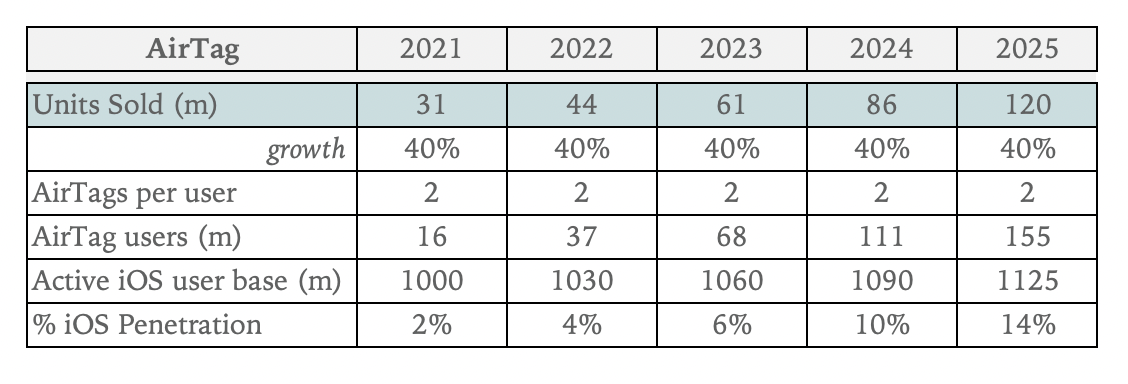

Using AirPods as a reference point, we can get a sense of how many AirTags could be sold over the next five years. AirTags star at $29 per tracker and $25 if purchased in a pack of four. At 1/6 the price of AirPods, it’s reasonable to anticipate Apple will sell more AirTags than AirPods. Applying a 4x factor yields 380m AirTag units in year five (2025). While 380m units feels aggressive, we believe 120m units in 2025 is reasonable based on a 40% compound growth rate.

Another test of our assumptions is comparing the percentage of iOS users that have adopted AirTag, AirPods, and Watch. The table below outlines this exercise. We’re modeling for each user to have two AirTags on average, with a replacement cycle of roughly four years. Putting it together, this would imply 155m AirTag users in 2025 and 14% iOS penetration, assuming the active iOS user base grows 3% per year from around 1B today to 1.1B in 2025. As a point of reference, this 14% iOS penetration would be similar to the attach rate to date for AirPods at around 15% and Watch at just under 10%.

If we’re correct on the 120m AirTag units in 2025, that would add just under $3.3B in revenue. Apple’s revenue in five years will likely be more than this year’s $333B, which means AirTag would be just under 1% of revenue in 5 years.

If we’re correct on the 120m AirTag units in 2025, that would add just under $3.3B in revenue. Apple’s revenue in five years will likely be more than this year’s $333B, which means AirTag would be just under 1% of revenue in 5 years.

A comparison with Tile

We can look at Tile, the market share leader in Bluetooth trackers today, for a revenue perspective. The New York Times reported in mid-April that Tile has sold over 26m units lifetime to date. Priced at $25 for the entry-level Tile to $35 for the Tile Pro, which implies around $750m revenue to date for Tile. Since AirTags were announced, Tile has essentially kept their pricing the same, although they are more aggressively promoting bundled offerings. While the Bluetooth tracker market is small today, we believe Apple will expand it over time for two primary reasons.

First, AirTags will have advanced navigation features that make use of an iPhone’s cameras, sensors, and mapping features, along with the Find My network of over a billion devices that can be crowdsourced to locate lost items. Tile’s network is about 2% of the size of Apple’s. It should be noted that Apple recently updated its Find My service, allowing third-party hardware makers to utilize its Find My network.

Second, while Tile has built a great business, its consumer brand recognition is a fraction of Apple’s. An illustration of this brand advantage is looking at the number of views on YouTube Apple receives versus Tile. Within the first day of the AirTag intro video being released, it captured more than 2.6m views and is now up to 5.5m. Apple’s Spring Loaded event video received more than 7m views on the first day and is now over 9m. For perspective, Tile’s most popular YouTube video has received 12m views over the course of three years.

The bottom line is AirTag is an example of Apple leveraging its ecosystem and global brand to create a more compelling product than what is currently in the market. Apple’s usually not the first mover in a market, but when it arrives it often does so with a superior product.