Apple shares have drifted lower following its record March quarter in which the company grew revenue 54% and delivered one of the best quarter beats in recent memory. Setting aside the current rotation out of tech, the key question exiting what was a remarkable quarter is: what is the company’s true growth rate over the next few years? Investors fear Apple pulled revenue forward, which gave the company more difficult comps in the years to come.

Comparing our model with Street consensus

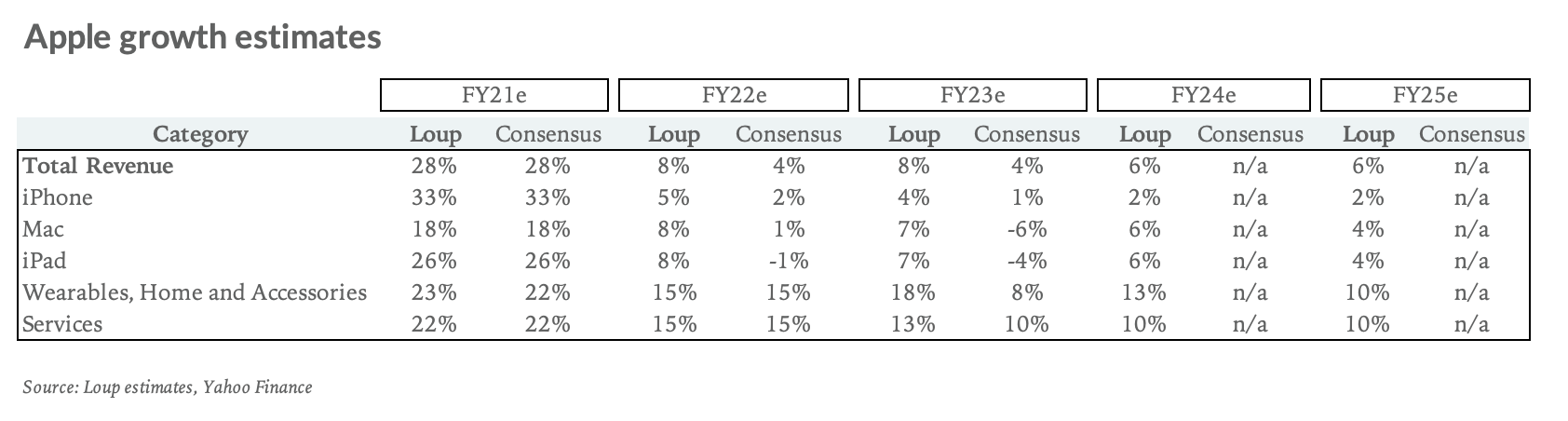

Here’s where Loup’s 5-year Apple model stands compared to consensus estimates.

For FY21 we are broadly in line with consensus. The notable part about our Apple estimates relative to Street expectations is the company’s growth in FY22, FY23, and beyond. While Apple will face more difficult comps as it laps pandemic quarters in which it benefitted from people spending more time learning, working, and playing from anywhere, we believe the company will continue to grow revenue in the out years ahead of expectations, driven by a longer-than-expected tail of the accelerating digital transformation.

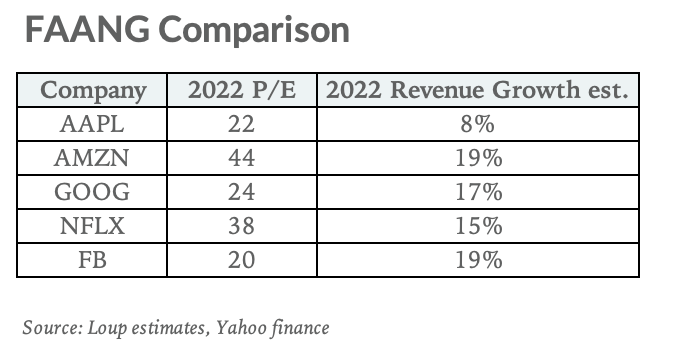

Contrasting Apple revenue growth with the rest of FAANG

Apple’s revenue growth rate outlook is lower than its FAANG peers, which factors in our more optimistic 8% revenue growth vs. the Street at 4% in 2022. We believe the continuation of the accelerating digital transformation, along with a multi-year iPhone 5G upgrade cycle and the addition of new product categories should sustain revenue growth in the high single digits for the next couple of years. By comparison, we believe the rest of FAANG growth rates will gravitate to a 10%-15% range.

Three-year outlook by segment

iPhone: While we are in line with consensus for FY21 iPhone growth of 33%, we believe iPhone can grow 5% and 4% in FY22 and FY23, respectively. This compares to consensus at 2% and 1%. We believe consensus is underestimating the magnitude of a multi-year iPhone upgrade cycle that we think will last through FY23. This multi-year upgrade cycle is anchored in a growing iPhone install base that is due for an upgrade, along with 5G enthusiasm, which will deliver data speeds 7x-20x greater than current 4G levels. While 5G availability and performance is limited in the US today, as carriers build out infrastructure this will change, which should, in turn, make 5G a “must-have” instead of a “nice-to-have” feature.

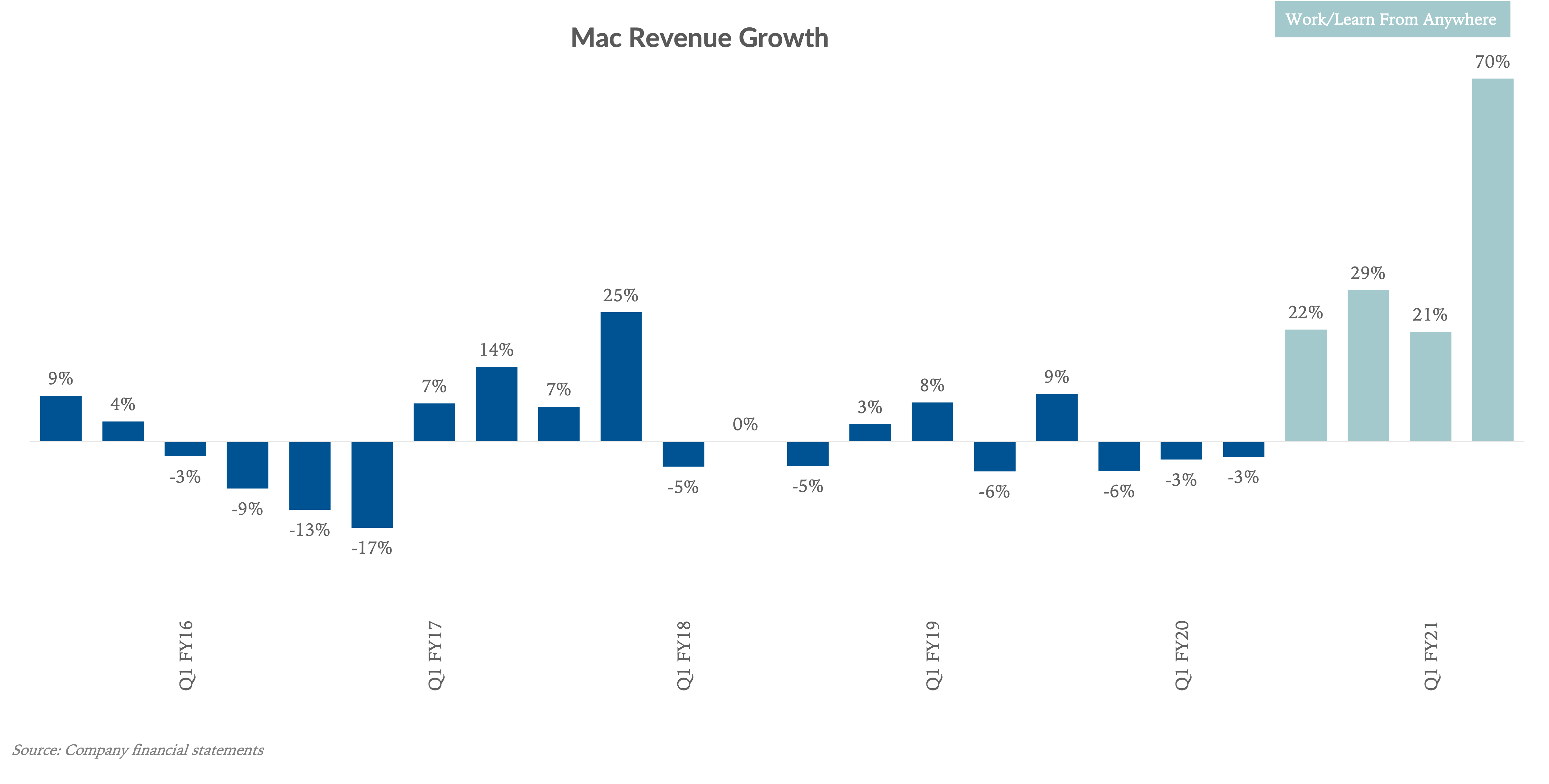

Mac and iPad: We think Mac and iPad revenues can grow 8% and 7% in FY22 and FY23, respectively, compared to consensus at 1% and -6% for Mac, and -1% and -4% for iPad.

We believe the recent growth rates of Mac and iPad are more sustainable than consensus is modeling. We think analysts are underestimating the power of the work- and learn-from-anywhere tailwind for the personal computer and tablet market. We believe this transformation will take longer than most expect to play out and will continue to benefit the iPad and Mac product lines for the next three years plus, as employees, students, and organizations settle into the new hybrid paradigm.

Keep in mind, in the five years prior to the pandemic, the Mac was essentially a flat business, growing on average 1% annually:

Wearables, home, and accessories (WHA): We are modeling for 15% and 18% growth in WHA in FY22 and FY23, compared to consensus at 15% and 8%. The divergence from consensus for our FY23 estimate is anchored in a belief that Watch and AirPods have significant room to grow. While Apple does not break out unit sales of these products, we estimate the iOS penetration rate for Watch and AirPods is 13% and 18%, respectively. This is assuming a four-year life for AirPods and a three-year life for Watch. Longer-term, we think it’s reasonable these penetration rates can reach 35% plus.

Post-pandemic, wearables will undoubtedly benefit from physical retail stores reopening. Apple noted in its recent earnings call that products like Apple Watch and Apple Care have been negatively impacted by the shift to online shopping, as both products normally benefit from the in-person shopping experience in Apple Stores.

While AirTag will not move the needle in the short term, we estimate that by 2025 the product could add $3.3B in annual revenue or about 5% to the WHA segment.

Services: We are modeling for 15% growth in FY22 and 13% growth in FY23, compared to consensus at 15% and 10%. The services segment faces difficult year-over-year comps as it laps quarters in which the world was locked down and people were spending more time at home. That said, we believe much of the behavior adopted during the pandemic will stick moving forward. Things such as the App Store are must-have services, pandemic or not.

New categories

It’s important to note that our model doesn’t include potential new business segments related to expanded hardware subscriptions, augmented reality (AR), and transportation.

360° bundle. Over the next several years, we believe the company will expand its hardware subscription offerings, building toward a 360° bundle. Think of this as paying a monthly fee to Apple for most of your tech needs. Today, about 55% of the company’s revenue can be purchased as a subscription. By widening its subscription offerings, we believe that number would approach 85%. This dynamic would increase Apple’s revenue and earnings visibility which should, in turn, expand its earnings multiple.

AR & MR. We expect the company will preview its mixed reality (MR) goggles this summer. While MR goggles will likely be a high-end niche product at the outset, we expect the company to move toward consumer AR glasses, likely around 2025. While AR continues to feel a bit like science fiction, we believe it’s a matter of when, not if, AR glasses are mainstream. To deliver the next computing platform requires expertise in hardware, software, and design, along with deep pockets to sustain R&D. With that in mind, we believe only a few companies, Apple, Google, Microsoft, and Facebook, have the potential to be major players at the AR table. In our opinion, Apple checks these hardware, software, and design boxes better than any other company.

Transportation. Last, regarding transportation, while we don’t know what Apple’s go-to-market strategy will be, the reality is that global transportation is a massive addressable market. Thus, whether the company builds its own Apple Car or elects to license software to other automakers, the transportation opportunity is the best chance for Apple to step into a new growth curve.

Where we could be wrong

Sustainability of the accelerating digital transformation: We could be overestimating the sustainability of the accelerating digital transformation. Said another way, the digital transformation that has unfolded over the past 12 months could be more of a pull-forward than a sustained step-up. The cautionary tale here is Netflix, which missed net paid sub adds by more than 35% in Q1 2021 and guided to one-fifth the number of subscribers that consensus was looking for in Q2. In the case of Apple, the risk would primarily be a step-down in growth rates for the Mac, iPad, and Services segments.

Regulation: A wild card related to the Services segment is potential App Store regulation. Apple and Epic are in the midst of a court battle over App Store take rates, and Apple is facing an antitrust lawsuit in the EU related to its App Store practices. We estimate the App Store accounts for about 35%-40% of all services revenue. If Apple is forced to cut its take rate in half from 30% to 15%, for example, the services segment would face about a 20% headwind.

New business segments: Apple’s potential new business segments could take longer than we expect to materialize, or not materialize at all. These include a 360° hardware-services subscription bundle, MR goggles and AR glasses, along with Apple Car. Given these potential product segments are not included in our model, their lack of fruition would not affect Apple’s financial performance. That said, a lack of materialization would likely drag on AAPL’s multiple.