Since early 2017, battle royale games, namely Fortnite and PUBG, have exploded in popularity. Not only have the games been a massive financial success, but a cultural phenomenon as well. There are countless examples of battle royale games making appearances in popular culture, notably in sports celebrations around the world.

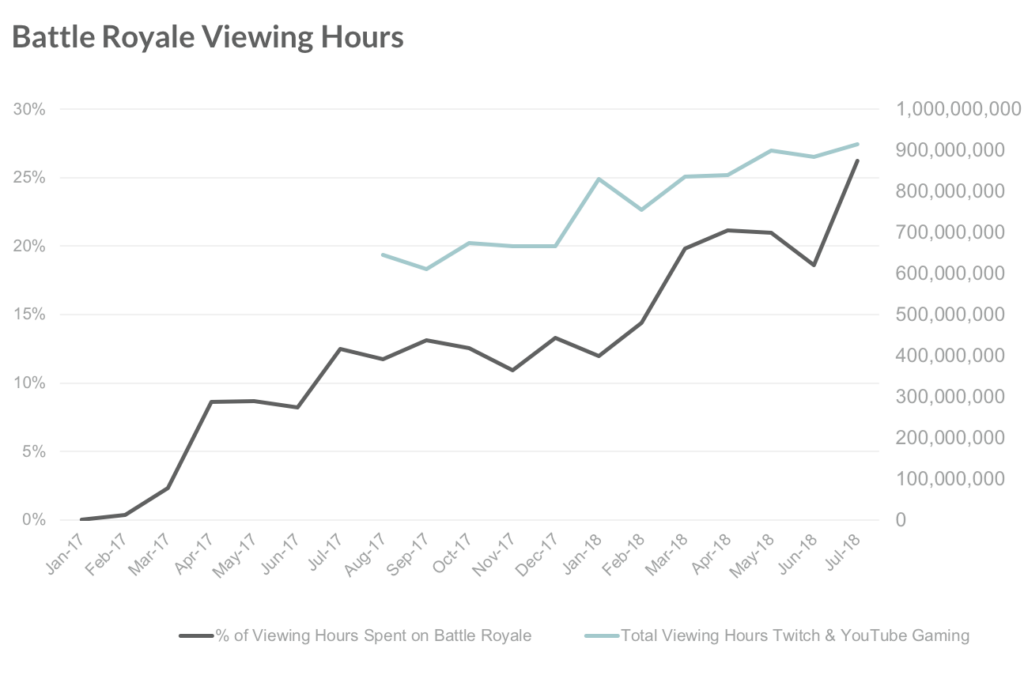

To put the success of battle royale games into perspective, it helps to consider the percentage of hours spent on Twitch and YouTube Gaming that have been devoted to Fortnite and PUBG. Those two games represent the vast majority of time spent viewing the battle royale genre.

According to The NewZoo Game Streaming Tracker, battle royale games accounted for over 25% of all hours viewed on Twitch and YouTube Gaming in July, up from roughly 10% a year ago. Overall viewing hours for Twitch and YouTube Gaming have been increasing in line with the overall share of hours, which suggests that most of the battle royale viewing hours are “new” hours spent on Twitch and YouTube, and are not negatively impacting hours viewed for other game types.

Compared to other games types, battle royale games are very easy to watch. General audiences can quickly pick up what the goal of the game is, the concept of the playable map shrinking, and the concept of looting. For other game types or first-person shooter (FPS) games, like Overwatch, viewers have a much harder time understanding what is going on if they haven’t played the game.

Battle royale is still in its early stages and viewership is only set to increase with the highly anticipated battle royale modes in the soon-to-be-released Battlefield V (EA) and Call of Duty Black Ops 4 (Activision). We’re also just starting to see the formation of esports competitions built for battle royale, with Epic Games’ financial commitment, the Fortnite Summer Skirmish Series, and the PUBG Global Invitational. As the competitive scene develops, we’ll see events more often, with better viewing experiences and larger prize pools.

We expect Fortnite to remain the core driver of the battle royale format for the foreseeable future. While it’s great that Battlefield V and Black Ops 4 will be adding battle royale as a game mode, we don’t expect these games to fundamentally change or dominate the category. Those franchises have been immensely successful in creating team-based first-person shooter games since the early 2000s and aren’t likely to deviate too far from what their core fans expect.

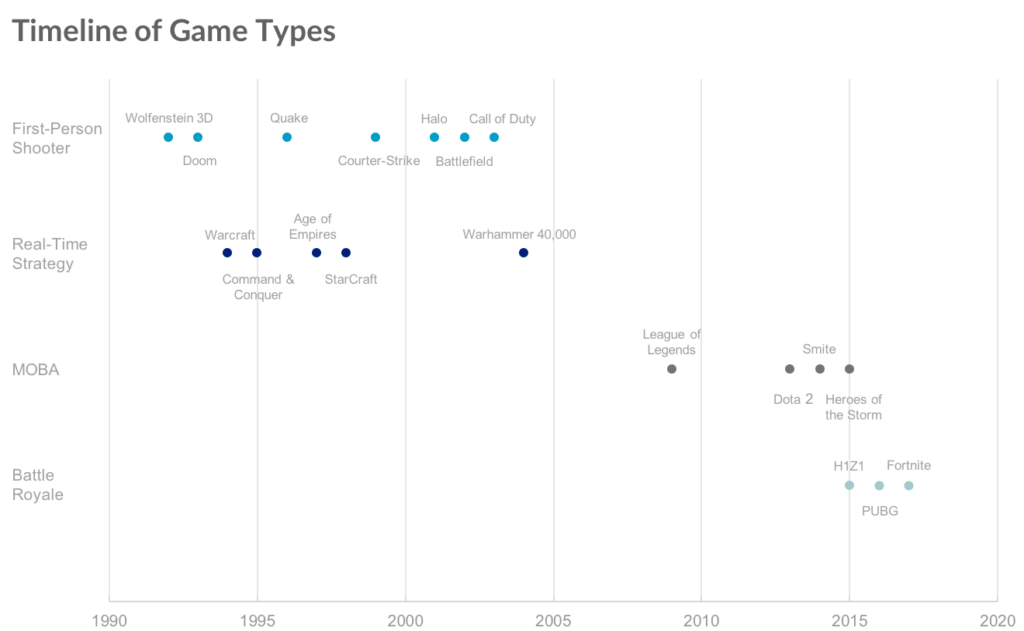

As we highlighted above, hours spent viewing battle royale games appear to be new hours spent on existing live-streaming platforms, thus it doesn’t spell the end for FPS or other game genres. Every so often, new games types rise in popularity and create a new category. In some cases, these new categories are modifications of existing game types. The multiplayer online battle arena (MOBA) game type started as a modification of StarCraft, one of the most popular real-time strategy (RTS) games. Today’s battle royale craze started as a modification of online survival games like Minecraft and ARMA 2. Brendan Greene, known as Player Unknown, created a battle royale mod for ARMA 2, consulted for H1Z1, and finally moved on to become the creative director at Bluehole games where he helped develop PUBG. In both of these instances, the communities created game types they wanted, and as the popularity of the game rose, major publishers took noticed and legitimized the game type by further developing it. This formula may be the key to finding the next Fortnite.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.