We surveyed the cost of food delivery services over the past three months and, unsurprisingly, found that the costs and premiums paid to use these services have both increased.

Methodology

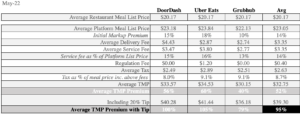

We surveyed ten meals delivered in Minneapolis across three major platforms (DoorDash, UberEATS, and Grubhub) to measure the costs of food delivery.

Costs continue to be impacted by the inflation drumbeat

We saw the impact of inflation in our survey, most notably with the cost of delivery and service fees increasing 77% over the past three months. These are the hidden fees that averaged $1.89 in March and reached $3.35 in May. Separately, we found that the base price of a meal increased by 3.2% over the three month period. While the meal increase was not as steep as the delivery and service fees, it does represent an annualized price increase of about 12%, outpacing overall inflation which runs about 8%.

Premium gap expands from 82% to 95% in three months

A second takeaway from our survey was related to the premium that consumers pay for using food delivery services. The average premium increased from 82% in March to 95% in May, including a 20% tip. As mentioned, the key factor in the premium increases is related to delivery and service fees jumping by 77%. In other words, you’re paying about 2X the normal price of a meal when you order through a food delivery service.

Here is a chart which summarizes our findings:

Further takeaways

- 2 out of 10 restaurants that we surveyed (Papa John’s, MyBurger) recently dropped Grubhub as a delivery service partner. We believe that the Just Eat Takeaway integration is resulting in a market share loss for Grubhub.

- On average, premiums were 52% (without a tip) and 95% (with tip).

- We continue to believe that these premiums are too high for mass adoption, especially in a hyperinflationary environment where consumers are finding ways to save money.

Food delivery is more expensive than you think

The first thing that stands out is the initial markup premium, which is 10-18% across the platforms. The initial markup premium is the difference between the meal price for pick up as compared to a meal price listed within the delivery app. We believe that most restaurants raise menu prices on delivery apps to offset the roughly 15-20% delivery and service commissions of the platform.

Delivery fees ranged from $2.74 to $4.43, on average. Since delivery fees remain consistent on orders over $10, their contribution to the total meal price varies by order size. Service fees are determined as a percentage of the platform meal list price, usually around 15%. This means that the dollar amount paid in service fees increases as the order size grows. While it’s not explicitly stated when the sales tax is applied, we think it’s applied after delivery, service and regulation fees have been added. This implies average tax rates of ~8%.

Time is money

In terms of cost of delivery, we found the markups to be egregious. That said, with food delivery, consumers are buying time. All said and done, we estimate that it typically takes 30 minutes to drive and pick up a meal. Factoring in a 95% delivery premium on a $20 order means that the customer is valuing their leisure time at $40/hour. Typically, people value leisure time over work time.

In other words, delivery is expensive—but worth it—for “time is money” consumers.