While the timing of Tesla reaching full autonomy is still an unknown, with Elon Musk less vocal on the topic over the past six months, the company is moving forward with the initiative. Tesla made it official, launching the subscription option for FSD. Expanding the addressable market for FSD through monthly payments is an important step along the long-term path to increasing margins, which will strengthen the company’s operating model. Improving profitability is central for mainstream tech investors to endorse Tesla as a true tech company.

The subscription option shifts the cost of FSD from $10,000 upfront to $200 per month (or $99 for cars that already have advanced Autopilot) and will play an important role in accelerating FSD adoption. The reason is because Tesla buyers are skeptical of the value of what seems like a pricy option, as evidenced by our estimate that nearly 80% of Tesla buyers pass on FSD at the time of purchase. Since owners can subscribe month-to-month, we believe a measurable 20% of annual buyers will give the feature a try. Initially, we expect most will quickly cancel the subscription, and over time as capabilities are added, retention will build. Fast-forwarding 10 years from now, we believe full autonomy will likely be required as a standard feature for all automakers, which would render the FSD subscription a moot topic. The good news for Tesla is that between now and 2031, FSD subscriptions can move the financial needle for the company.

FSD falls short of its name today, will live up to it over time

Today FSD is far from full self-driving and falls short of its name. Over time, we believe it will deliver level 4 or 5 autonomy, thereby living up to the name. Today, there are five key features enabled, including navigate on autopilot, auto lane change, auto park, summon, and traffic light and stop sign control. In essence, FSD today works on highways and in parking lots. Tesla makes it clear when considering FSD that the enabled features require active driver supervision and that it does not make the vehicle autonomous, which begs the question of why the company has named the offering FSD. The answer is eventually the product will be fully autonomous as new features are adding, including autosteer on city streets later this year.

FSD will have a powerful impact on Tesla profits

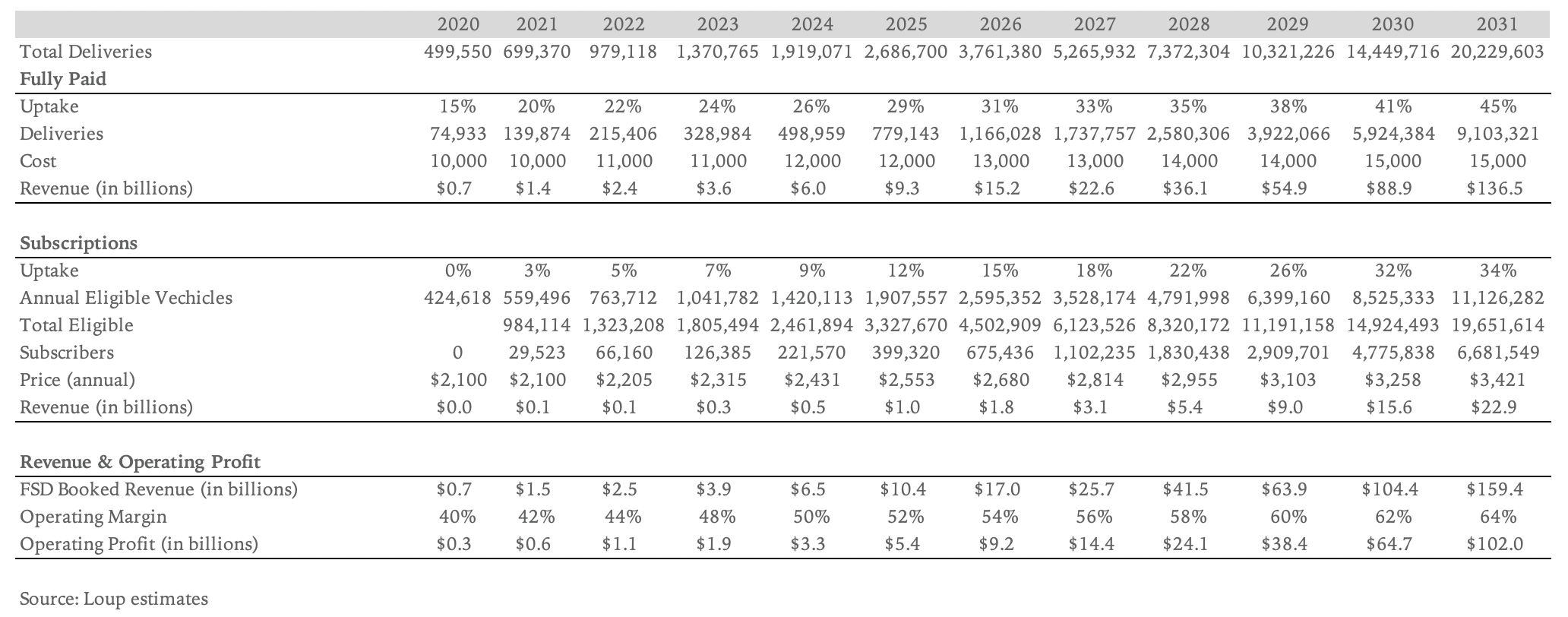

The math around the potential of FSD is hard to believe. We believe over the next decade, booked operating profit from FSD upfront and subscriptions will increase from $600m in 2021 to $102B in 2032. This implies today that 20% of annual buyers purchase FSD upfront and 3% of the remaining eligible vehicles subscribe. As features are added over the next five years, we believe those numbers will increase to 31% and 15% respectively, climbing to 45% and 34% in ten years. That means in 2031, about 80% of Teslas on the road will have FSD. As mentioned, looking past a decade, we expect full autonomy will be a required feature to sell cars globally. In terms of operating profit, we’re modeling for operating margin to increase from 42% this year to 64% in a decade.

What does this mean for TSLA valuation?

Ultimately it’s up to Tesla investors to decide what multiple to assign to the company’s FSD profits. That said, there is room for earnings expansion. Assuming our estimates are too optimistic, and the company does a third of the FSD profits in 10 years that we’re predicting, applying a 25x multiple on those profits suggests FSD alone is worth $850B in a decade, compared to the company’s current market cap of $620B. Keep in mind that a portion of Tesla’s current valuation is already pricing in some FSD success.