For twenty years, the team at Loup has had a pulse on technology and a point of view on how that tech will change the world. The cutting edge of that change is frontier tech, driven today by AI, fintech, robotics, autonomous and electric vehicles, and virtual/augmented reality. We provide exposure to these themes through our partners at Innovator Capital Management. For more information click here.

Why Frontier Tech?

Frontier tech represents the forward-most edge of understanding and achievement in technology. By definition, what is frontier today will not be frontier tomorrow—it is dynamic. These are the technologies with the greatest opportunity to create value for investors.

Loup Frontier Tech Benchmark

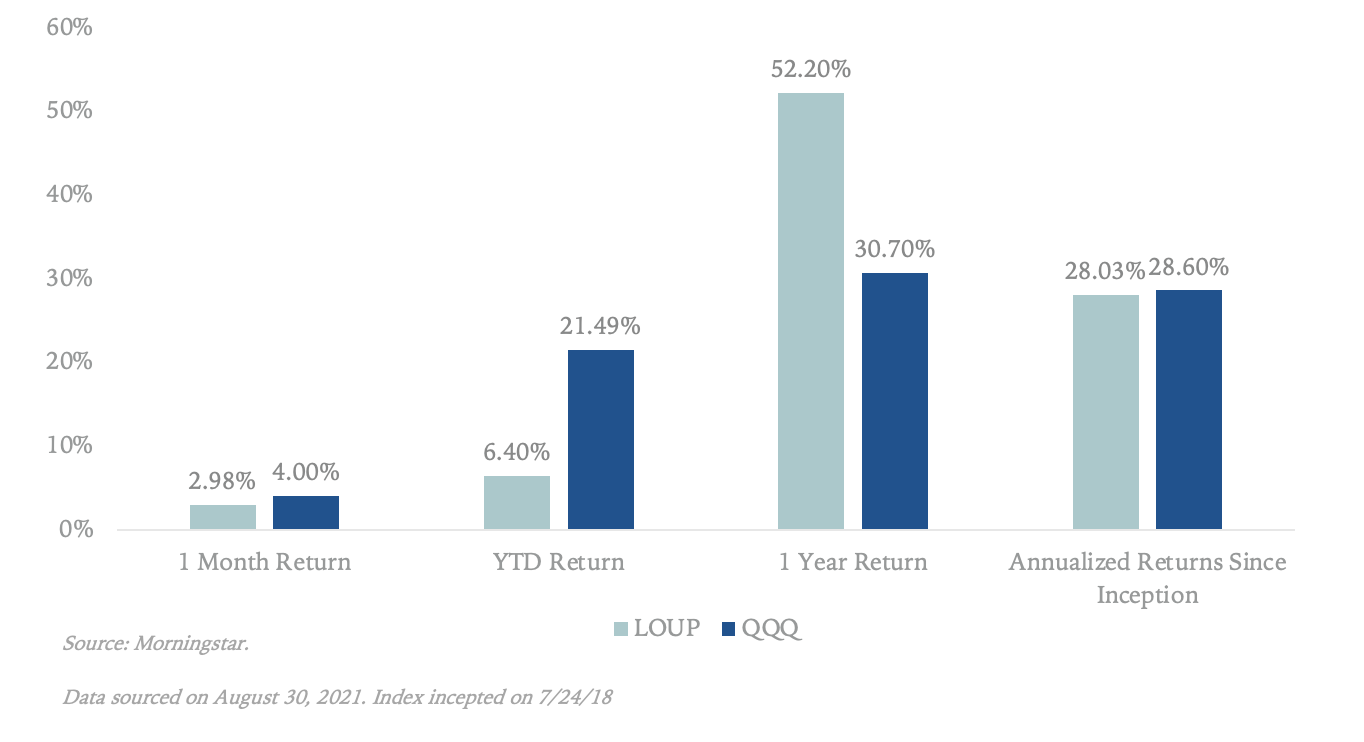

Here is the Loup Frontier Tech Index performance update as of August 31, 2021:

What’s on our minds this month

Two Chinese companies, Baidu and Huya, represent about 9% of the Loup Frontier Tech Index. These stocks have traded down significantly year-to-date as investors braced for regulation around gaming, along with a confrontational posture from the Chinese government toward tech companies. The recent clarity on gaming rules, which prohibit students in China from gaming Monday through Thursday, was positively received by investors given the unknown around impending regulation is now known. Over the last decade of following Chinese internet companies, we’ve seen a pattern of initial investor concern around regulation, followed by six months of relief as the details are clarified. In the years ahead, we expect this cycle to continue and we believe the long-term potential in China outweighs the risks.

Separately, Affirm Holdings (4.5% of the index) signed a deal with Amazon. Shares moved up about 40% on the news.

Changes to the Loup Frontier Tech Index

GXO Logistics (NYSE: GXO). The only change this month was swapping XPO Logistics with GXO Logistics, which was a spin-off from XPO. GXO is an intelligent warehouse management business that will build into the robotics fulfillment theme. The company’s two largest customers are Apple and Nike, managing their fulfillment operations.

Top 10 Holdings (Weighting as of August 31, 2021)

- Harmonic Drive Systems Inc, 4.79%

- Snap Inc, 4.72%

- Baidu Inc, 4.55%

- Affirm Holdings Inc, 4.49%

- HUYA Inc, 4.38%

- SK Hynix Inc, 4.35%

- GXO Logistics, 3.89%

- Unity Software Inc, 3.40%

- Lumentum Holdings Inc, 3.21%

- Pegasystems Inc, 3.19%

Weight by Theme

- VR/AR – 39.5%

- AI – 19.5%

- Robotics – 14.5%

- Fintech– 16.0%

- EVs/AVs– 10.5%

Learn More

The Loup Frontier Tech Index tracks the performance of publicly traded companies developing frontier technologies including, but not limited to, AI, fintech, robotics, autonomous and electric vehicles, and virtual/augmented reality. We’ve licensed the index to Innovator Capital Management. For more information click here.

Register for our next Tech Roundtable with the Loup team, a quarterly webinar to discuss the latest in frontier tech.