Since we started writing about tech addiction as a potential market opportunity, we’re often asked, “What exactly are the opportunities?” We see opportunities across three broad categories:

- Health services

- Leveraging healthy addiction

- Augmentation

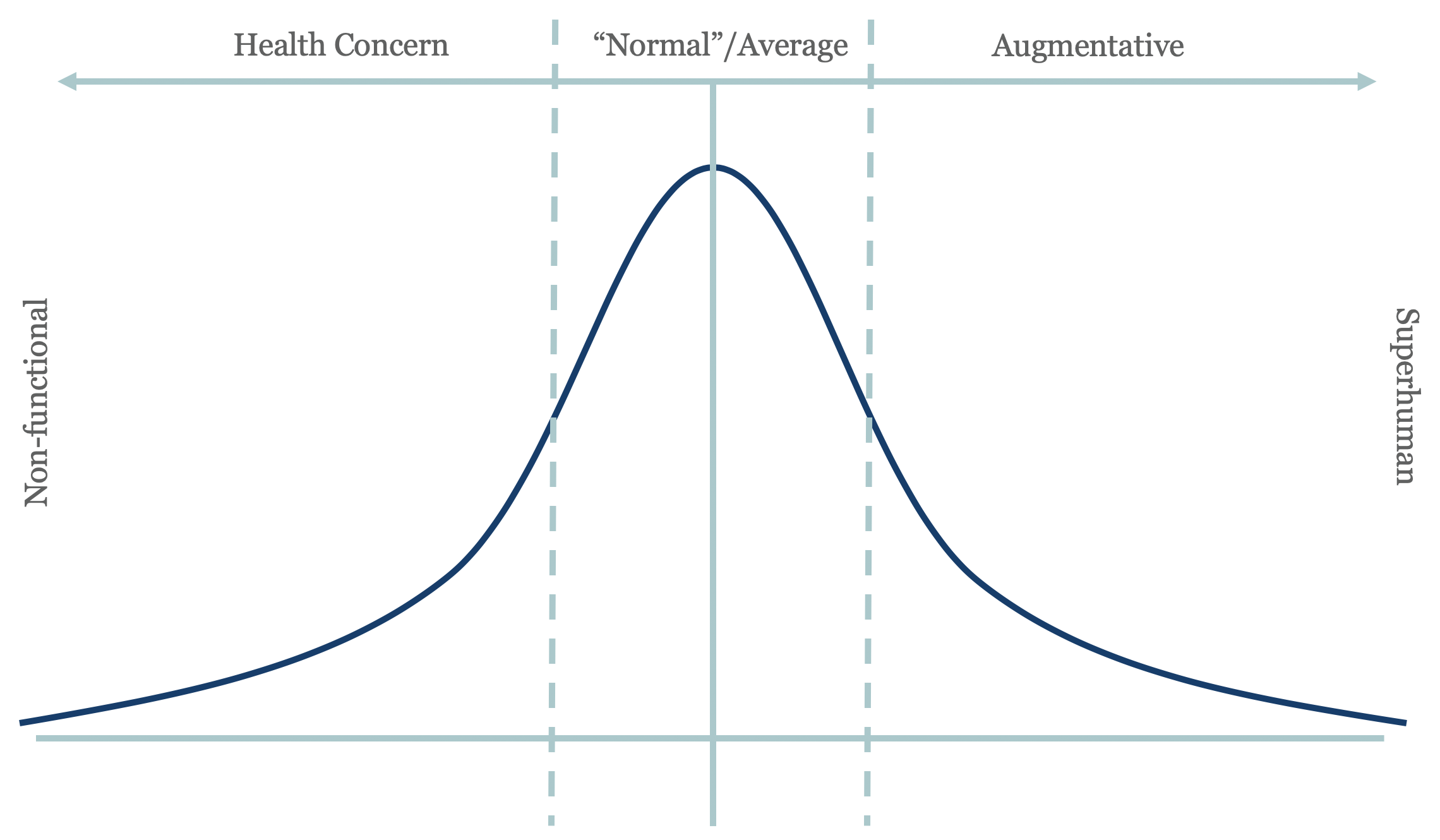

These opportunities can be visualized along a bell curve that describes how addicted someone is to technology. The more addicted someone is to technology, the more dysfunctional or non-functional they are, as represented by the left side of the curve. The more one gives up non-essential tech, the less they are addicted and the more superhuman they become.

Addressing health concerns

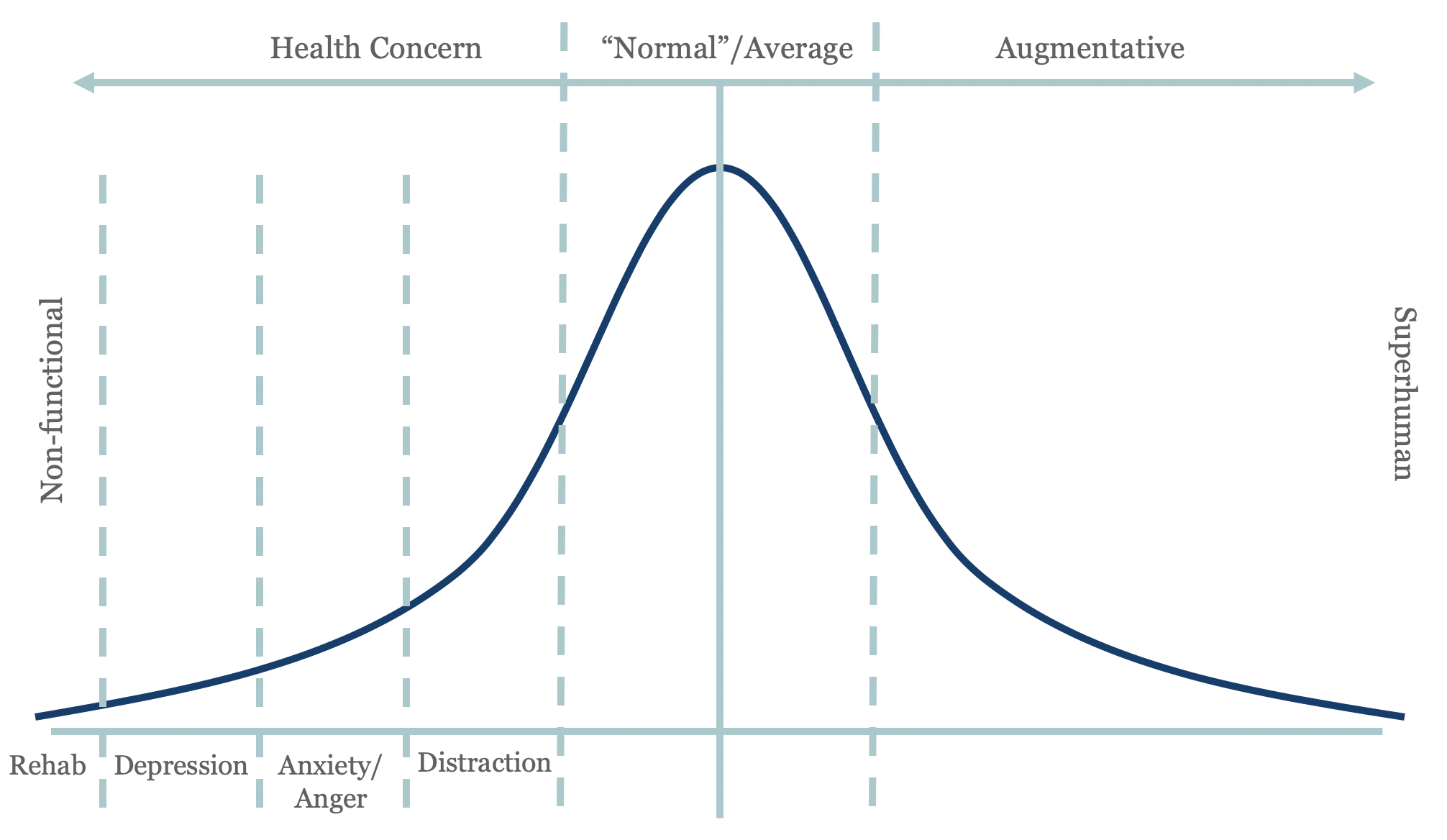

Most of the discussion about tech addiction focuses on its health impacts: distraction, anxiety, anger, depression, even suicide at the extreme. Whether tech addiction fits the clinical description of “addiction” isn’t relevant. Intuitively we know that spending excessive time with our devices isn’t healthy and causes mental and physical issues.

There are three ways the market can address the left-hand side of the curve:

- Regulation. Governments may feel the need to step in and regulate the usage of technology. We already see examples of this in France, where smartphones are banned from school, and China, where the government has begun enforcing stricter policies on online games. Regulation is useful, but the trick is that people don’t want to be told what to do, even if governments are protecting people from themselves. Prohibition created a black market for alcohol. People will find ways to circumvent overly oppressive restrictions on technology, which would be required to broadly address the health issues created by tech addiction.

- Rehab. Rehab programs already exist to help with extreme cases of technology addiction.

- Novel health solutions. There are several encouraging new approaches to treating anxiety and depression. These include digital therapy solutions and non-invasive devices that leverage emerging neurotechnology concepts.

Unfortunately, there aren’t likely to be many direct ways to invest from a venture perspective in tech addiction on the health concern side of the curve. We’re interested in novel health solutions around anxiety and depression, especially those that leverage neuroscience research; however, our interest there isn’t specific to treating tech addiction. Helping tech addicts would be a secondary benefit of these investments. In fact, if the purpose of those novel solutions were to solely treat tech addiction, it might be more difficult for us to be interested. There’s something unappealing about medically treating anxiety and depression resulting from tech addiction rather than just addressing the cause of the issue.

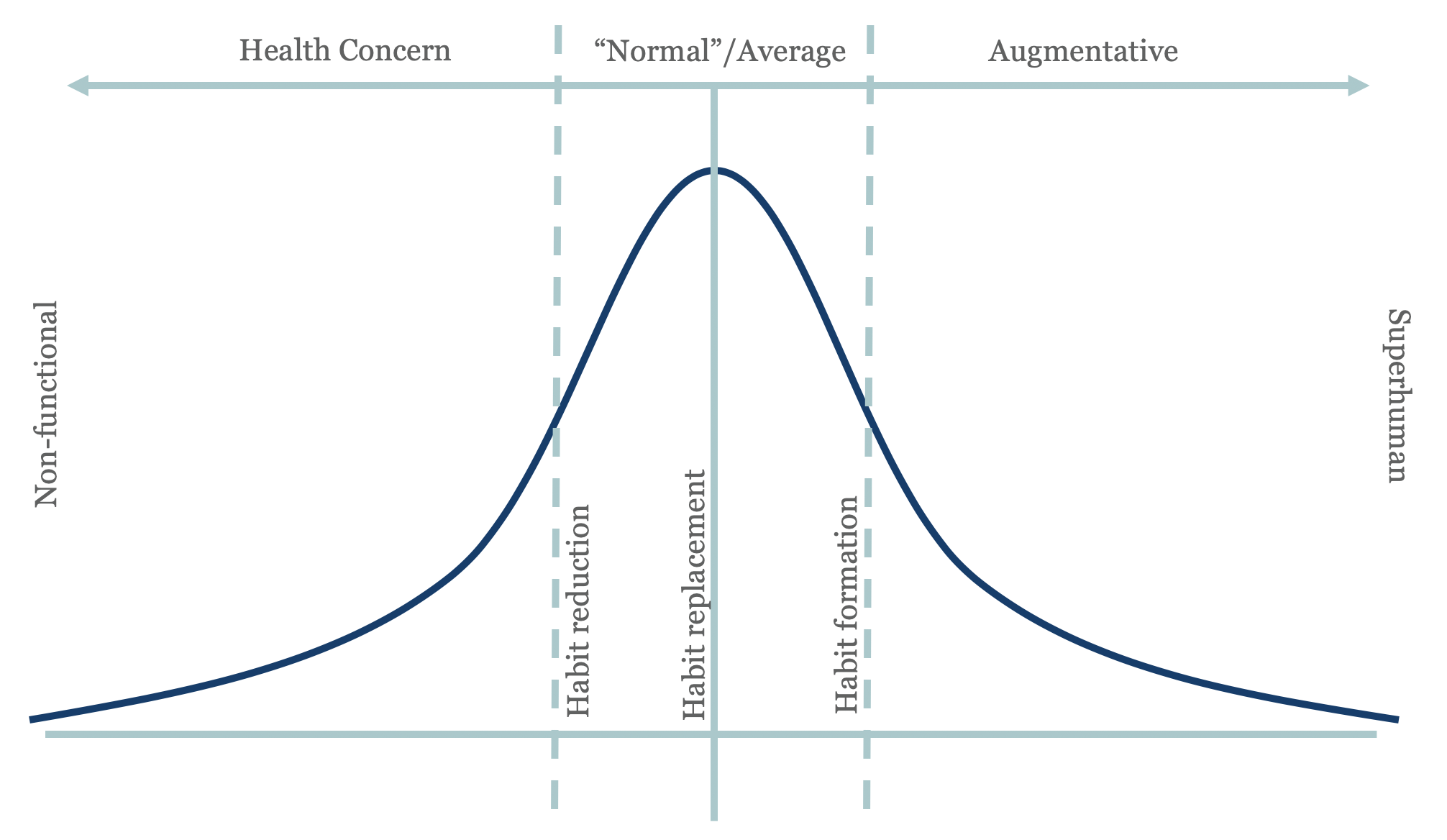

Creating healthier habits for the average

The majority of the tech-using population fits into the average of the curve, which we would describe as subject to some addictive behavior, but not to the extreme of causing serious health issues. This isn’t to say technology usage habits of the average are optimal – far from it. Normal tech users just aren’t meaningfully worse or better off than the majority.

There are three opportunities to create healthier habits for the average:

- Habit reduction. Habit adjustment businesses help average users reduce the amount of time they spend with technology. Apple’s Screen Time and Google’s digital well-being software are examples, as are a large number of third-party apps that track and limit screen time.

- Habit replacement. Habit replacement switches an average tech addict’s unhealthy habit for a healthier one that provides more net value to the user (defined below). An example of habit replacement could be replacing Facebook with healthier social media products. Remember, these opportunities are focused around the average tech addict, and we don’t expect the average to give up social media. Therefore, there may be opportunities to create social experiences that reduce some of the negative effects of social (envy, anger) and replace time spent on existing platforms. We think that animation-based products may be useful here.

- Habit formation. Habit formation is the active creation of a healthy habit by leveraging the average user’s addiction to their devices. An example might be building addicting mechanisms into health, fitness, or study applications.

In many ways, these three opportunities are closely related and could be broadly thought of as habit adjustment. The nuance to us is where each opportunity sits on the curve. Pure habit reduction feels most closely related to addressing health, habit replacement seems to be in the middle, and habit formation feels slightly augmentative. Out of all the tech addiction opportunities we’ve highlighted, the biggest from a venture outcome perspective will probably be in habit replacement and formation. We’d expect to see the most effective solutions to address tech addiction for the average user to come from those categories.

Augmentation

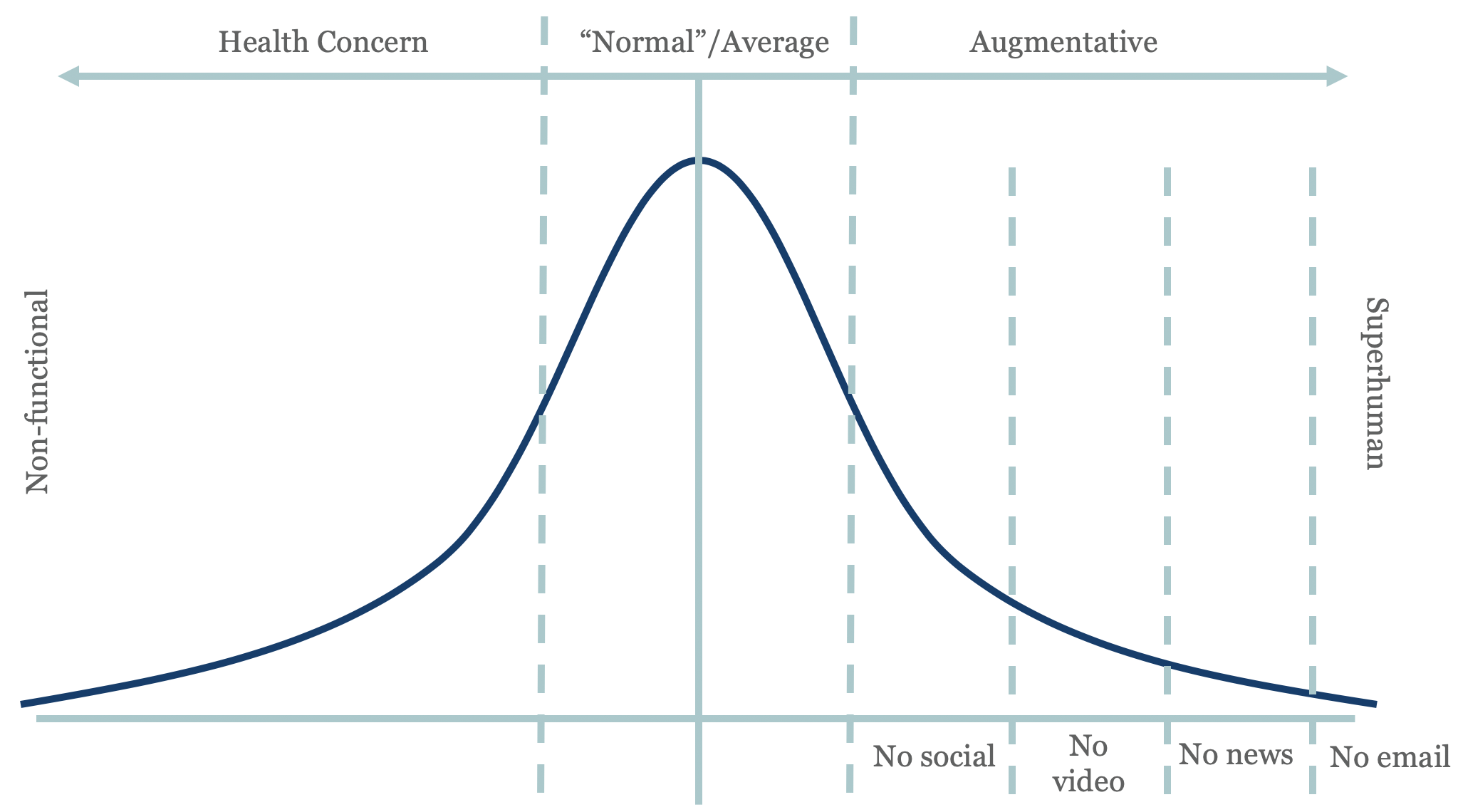

A minority of tech users will voluntarily limit device and software use for health and performance benefits. When we tested the Good Phone (a distraction-free iPhone), the power of minimal tech became very apparent to us: we were able to focus better, felt more creative and relaxed, and we got more important things done. We felt superhuman, which is an apt description relative to both the left and middle parts of the curve.

There are two core opportunities in the augmentation space:

- Devices. Again, reflecting on our experiments with the Good Phone, we don’t believe software alone can push tech users into the realm of augmentation. It can only improve them within the average section of the curve. Because addiction to tech is so powerful and the urge for stimulation in times of boredom will always exist, we need devices created with the purpose of severely limiting unhealthy and inefficient use cases. We define the health of a tech use case in terms of net value, which is the positive effect of the tech minus the negative effect. We’ll explore this more in a future post, but social media, entertainment apps (YouTube), news, and email are net negative apps that the four major categories we believe need to be eliminated if the goal is augmentation. The more of these a user eliminates, the closer they move toward being superhuman.

- Movements. Anytime a small group of people embraces a non-consensus or alternative view, it becomes like a religion or cult out of necessity. Believers have to have a strong sense that what they’re doing makes them somehow better than the herd or they wouldn’t associate themselves with that alternative view. We’d expect people who embrace the tech-light lifestyle to create a community that experiments with different ways to limit the use of tech, develops their own insider’s lexicon, and evangelizes the benefits of the movement. Crossfit is a good recent example.

Perhaps even more than the prior two sections, the opportunities in devices and movements around augmentation are tied together. Tech-light devices provide the tools, while the movement provides the religion. We think the tech-light device space could be an interesting market to address outliers that want to avoid technology addiction, particularly if a movement can be created around a product. Finding ways to eliminate tech use may be the most powerful sports supplement for the mind; however, it’s probably a smaller overall opportunity than habit replacement and formation given a much smaller user base.

As the conversation around tech addiction continues, interesting solutions across all segments of the market will emerge. Few are likely to be venture-investment worthy (we invest in a little over 1% of the companies we look at overall), but many are likely to be market worthy. We will continue to experiment and explore to help create healthier relationships with technology for everyone.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.