This is the third of a four-part series exploring the concept of the Metaverse. Authored by Loup Ventures analyst Pat Bocchicchio, Part III explains how the virtual universe’s economy could operate and all the new business opportunities that would come with it.

In the first part of the Metaverse Explained Series, we gave an overview of what the Metaverse is and painted a picture of what it could be like to experience for yourself. In Part II, we explained why you should care about the Metaverse and why it has the potential to be one of the most impactful technological developments of the next 50 years. With a foundation established, we will now take a closer look at the economics of such a massive opportunity.

The Metaverse Economy

As we described in Part I and Part II of the series, the Metaverse is a virtual reality-based universe where you can do anything, be anyone, or go anywhere, regardless of real-life circumstances. In such a place, similar yet very different from our own, it’s not hard to imagine all the opportunities that will come from inhabiting new “earths” unbound by the laws of physics. Together, these worlds, all with different themes and features, will become a network that will be the successor to the internet.

What we have in the Metaverse are two major disruptions:

- The Physical World

- The Internet

The Metaverse is the 2D internet in the form of a 3D virtual universe. The economic implications of this combination are massive opportunities that could drive tremendous growth in the real world for decades to come. First, we will look into the economics of creating and operating a world within the Metaverse.

The New New World

In the late 15th century, Christopher Columbus led the Nina, the Pinta and the Santa Maria west until he reached Asia where the riches of spices and gold awaited. Little did he know the Americas and an opportunity to start a new civilization would be in his way. We often ask ourselves, where will the next generation of voyagers be headed next? The default answers are the Moon, Mars, and Europa, but the Metaverse could be the more likely destination, especially in the near term.

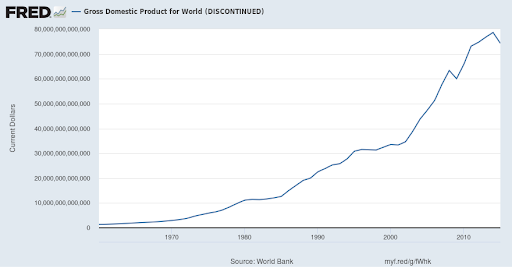

As gross world product (GWP) approaches $100 trillion, it is hard to deny there isn’t a massive economic incentive for the 21st century’s Sir Walter Raleigh, Henry Hudson, and Samuel de Champlain to begin building new cities and civilizations in the Metaverse.

Everybody Wants To Rule The World

The Metaverse will be a network of worlds all with different things to offer and varying levels of popularity. The first mover advantage and network effects will be important factors in the rise of the first most successful worlds. But over time, as we’ve seen since the dot-com bubble, the worlds/websites with the most traffic will come down to who can offer the best service and features.

The way to think about monetizing traffic in the Metaverse is very similar to the ways both governments and shopping malls generate revenue. San Francisco-based startup, High Fidelity, is pioneering ways to monetize its very early beta of a social virtual world. Ranging from leasing space in coveted locations to basically taxing transactions in its marketplace, developers of top locations in the Metaverse will be compensated accordingly for their efforts. All of this competition for capturing value in the Metaverse will result in the same capitalistic forces that have built most civilizations in modern history.

The New Internet

Monetizing the Metaverse goes far beyond just thinking about it from a traditional collection of physical locations, towns, and cities. As we continue to reiterate, the Metaverse is the successor to the internet, and all the worlds of the Metaverse are the equivalent to all the websites of the internet. We can now visualize and experience all of what the world wide web has to offer with a natural, 3D user interface.

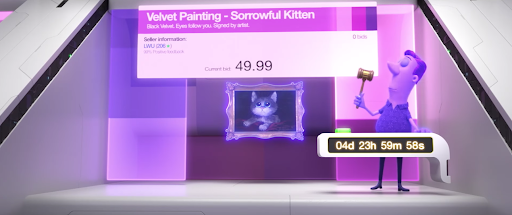

This new interface will unlock endless new opportunities for existing websites to completely reinvent their user experience. Think about going from shopping on Amazon.com to visiting the virtual Amazon Mall in the Metaverse. In the 2018 animated film from Disney, Wreck-It Ralph 2, we saw an interesting visualization of what an eBay auction warehouse would look like in the Metaverse. Instead of looking at a few photos and reviews on a 2D webpage, you can touch and test out the digital version of an object before making a bid.

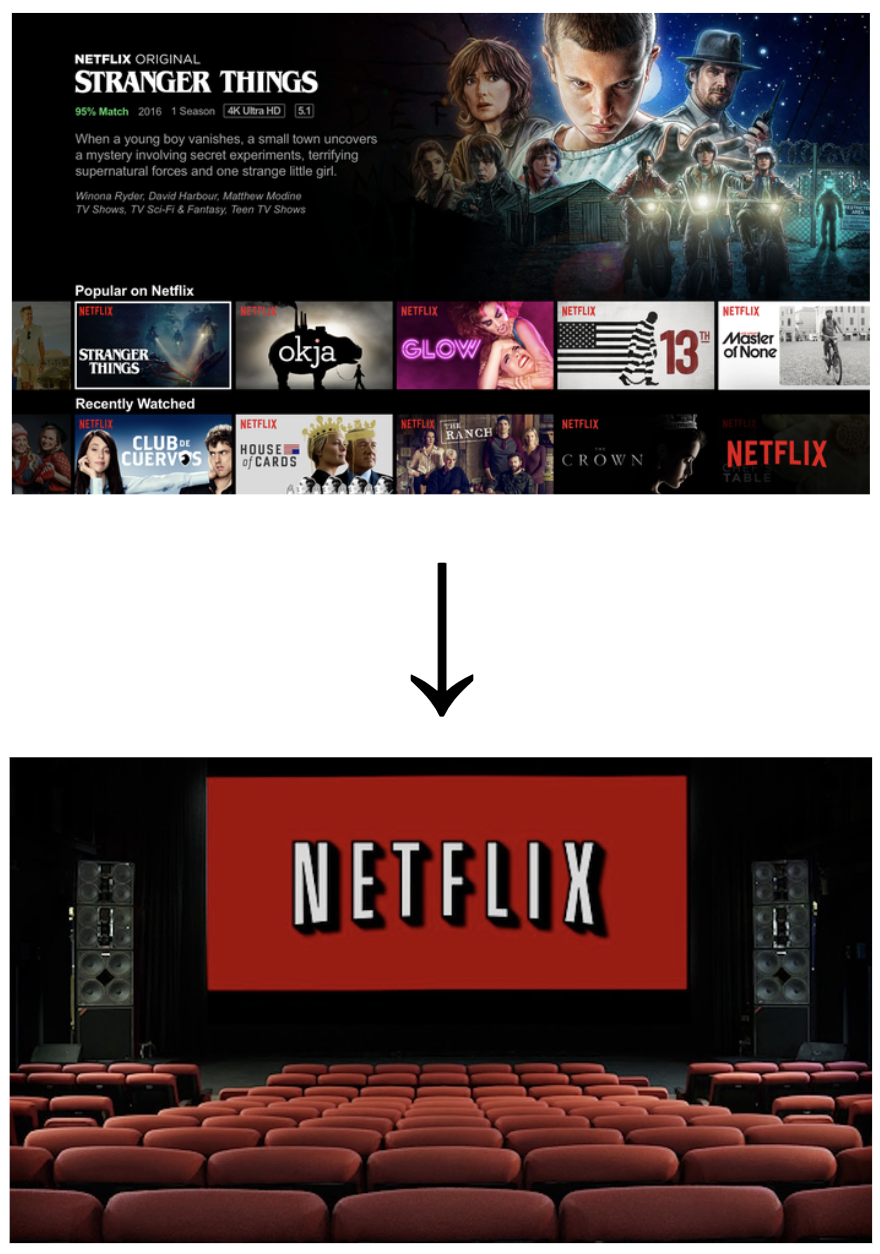

Think about all the new growth opportunities for a company like Netflix. As of now, they almost entirely generate revenue from subscriptions to their entertainment platform. It’s likely they will begin to diversify in the not too distant future in ways that go beyond selling merchandise or opening up a theme park as Disney has. Netflix chooses not to include any advertisements on their website because ads, especially un-skippable video ads are intrusive and can heavily detract from a user experience. But thanks to the Metaverse, Netflix can open Netflix theaters and monetize the traffic of their near 150 million viewers in brand new ways.

Simple poster ads on the walls, merchandise stands, or options to order in Domino’s will change the business model of Netflix forever. Netflix already has its own personal VR movie theater app – it’s a matter of time before that experience becomes social and adds many new lucrative features.

Put simply, when the internet gains the functionality to walk inside of it, companies will have a new wave of opportunities to explore.

High Fidelity Case Study

Now that we laid out a few of the high-level ways the Metaverse can be monetized, we will examine an existing company’s take and progress in building a Metaverse economy. The 50 employee team of High Fidelity is led by Philip Rosedale, creator of the once wildly popular PC-based virtual civilization, Second Life, which had over one million monthly active users and close to $1B in annual virtual goods transaction volume.

Second Life was an interesting experiment in virtual economics, and there are many lessons to be learned from it. However, we will be focusing solely on the Second Life successor, High Fidelity. High Fidelity is a very early access, VR-based social world backed by Google Ventures, HTC, and others. While still very far from the Metaverse we think is on the horizon, High Fidelity is a fantastic example of how the building blocks of the Metaverse and its economy are already being put in place.

High Fidelity Marketplace

The cornerstone of the High Fidelity Metaverse is that everybody is given open source tools to build anything they can dream of like avatar clothing, new items, and buildings. Creations are certified and recorded on the blockchain, then made available for purchase in the High Fidelity community. The blockchain allows the items you acquire or create within a game to be linked to you, rather than a specific game or world. In the Metaverse, there will be many different worlds and experiences that need to be linked seamlessly so it feels like one single universe. You could then bring your avatar from one world to another, freely importing and exporting your skills, belongings, and appearances. Check out the High Fidelity Marketplace to see all the crazy things people are building in the Metaverse and making real money on right now.

Bank of High Fidelity

With a global user base, there needs to be a way to standardize transactions. To solve this problem, High Fidelity created its own cryptocurrency called High Fidelity Coin (HFC). HFC cannot be mined by users as Bitcoin can, and this makes it a stable cryptocurrency, meaning 100 HFC is equal to 1 USD, always. High Fidelity has its own bank with a real staff where you can buy HFC, redeem HFC for real currency and more. High Fidelity makes a good part of its money by taking a 10% cut of all transactions in the marketplace.

Economic Impact

With an economic system in place, the Metaverse will be in the position to drive significant growth across every industry. Wall Street analysts will be asking the CEO of Ford, Coke, Apple, and most others what their Metaverse strategy is on earnings calls. Companies will have entire teams dedicated to thinking about ways to advertise, sell, or even build a product within the Metaverse. Entrepreneurs will have a new platform on which to build products and services that can change the world.

Some studies forecast over 50% of today’s children will have jobs that don’t exist yet. These jobs very well could be in or related to the Metaverse. One example is architects that will be designing the extraordinary buildings of the Metaverse and selling them on the open market, then getting paid in cryptocurrency that they can spend in or outside the Metaverse.

Conclusion

The Metaverse will be monetized in similar ways that cities and the internet are today, as well as brand new ways that will seem obvious once they exist. Today, every company needs a website and/or an online business strategy. Tomorrow, companies will have entire teams dedicated to thinking about ways to advertise, sell, or even build a product within the Metaverse. A new generation of entrepreneurs will be able to make a living or build the next big tech company thanks to the economic structure put in place in the Metaverse.

What’s Next

In the final edition of the Metaverse Explained Series, we’ll discuss the challenges associated with building something as ambitious as the Metaverse and the concerns people have about spending time in a virtual world.

Part I: Metaverse Overview & Tour

Part II: Why the Metaverse Matters

Part III: Metaverse Economics

Part IV: Metaverse Challenges

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.