Where do I start? An easy place is that I was wrong.

I believed that, long term, Zillow’s outsized brand in the US residential real estate market would be a competitive advantage in winning iBuying customers. My thinking continued that while the Zestimate had its flaws, it would get better over time and allow for more accurate bidding, thereby reducing the capital risk of buying and selling homes. We’ll never know how this would have played out because Zillow abruptly exited the iBuying business.

CEO Rich Barton said that Zillow takes big swings and is willing to fail fast; for me, this takes failing fast to a new level. I believe that Zillow exited iBuying because they didn’t want to kill the golden goose.

A win for real estate agents

Zillow’s recent move is a win for real estate agents. I’ve heard from agents over the past year voicing concerns that the Zesitmate is not industrial strength and that the nuances of real estate require a human to price properly. Barton agreed with this assessment, saying the company had been “unable to predict future pricing of homes to a level of accuracy that makes this a safe business to be in.” A reality check for the accuracy of the Zestimate.

The debate about the future of iBuying is still on the table because Opendoor remains in the market. They’ll transact more than 20k homes this quarter, over 50% of the overall iBuying market (purchases and sales). Of course, as Zillow winds down their iBuying activity through early 2022, Opendoor’s share will increase sharply.

I believe home sellers want ease, speed, and visibility. iBuying remains a compelling product to meet those unmet needs. My long-term view stands beside the fact that iBuying took a step back with Zillow’s exit. Zillow’s exit is testimony that pricing homes is harder than it looks, which is a win for agents, arming them with a powerful message to their potential customers: don’t go the iBuying route, Zillow tried and failed.

Not willing to kill the golden goose

In the spring of 2007, I spoke with an Apple executive. The company had just announced the iPhone, and the spokesperson commented, we just killed our golden goose. The golden goose was the iPod, accounting for 55% of revenue in the quarter reported before our meeting. The executive continued, if we don’t kill the iPod, our competitors will do it for us.

As I listened to the Zillow earnings call and processed the justification for getting out of iBuying, I was torn between two thoughts. On one hand, I was thinking that iBuying will never work because the biggest brand in real estate has failed. If they can’t do it, no one can. On the other hand, I was remembering Apple’s comment from 15 years ago. I went back to the Zillow earnings transcripts from August and November to better understand why they pulled the plug and two things became clear.

- Zillow has always believed scale was needed to build a predictable iBuying business. They mentioned ‘scale’ ten times on the August call and eight times on the November call. The irony of the scale topic is that Zillow just gave Opendoor a clearer path to scale.

- Zillow didn’t want to destroy their core IMT business of selling leads to agents. Long term, Zillow Offers would have competed with the company’s IMT gravy train, which increases tension with Zillow’s only paying customers, the agents. The underlying message to these agents had been “we want to partner with you and eventually put you out of business.” The reversal changed that message to “we want to partner with you.” Barton’s comment that IMT is an “incredibly strong core business” underscores that it’s Zillow’s golden goose. And Zillow is not willing to kill the golden goose.

Great vs. legendary

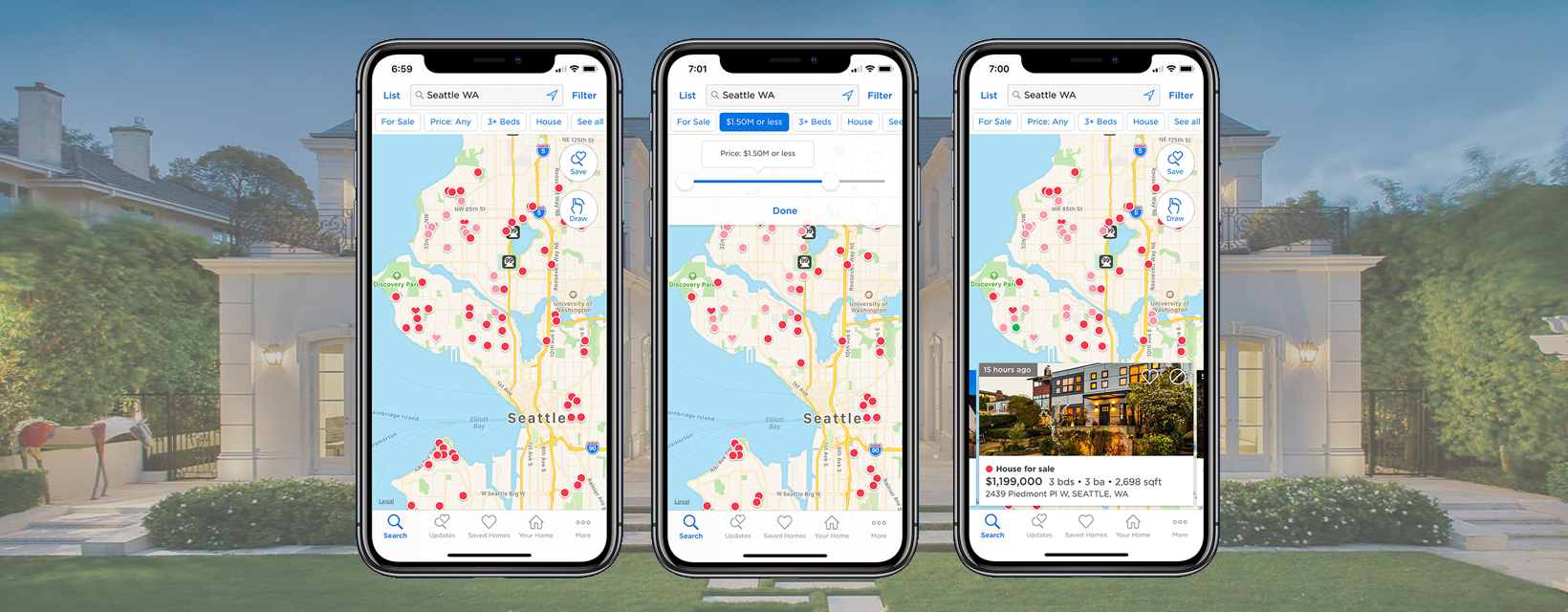

I love the Zillow app. I check it more times than I want to admit. Zillow boasts 227m monthly active users, more than 2x higher than its closest competitor. I see the value of the company’s updated vision as a return to building a 40% EBDITA margin marketplace with new products around the core IMT business. They will work more with agents and third parties to expand the mortgage business and add escrow, title, and closing. Who knows, maybe even partner with an iBuyer.

While that vision will likely grow into a highly profitable business and reward investors along the way, it falls short of the DNA that legendary companies are built on, like the ‘bet the company’ culture that has allowed Apple to thrive over the past 20 years and Tesla over the past five. Zillow has chosen its path.